From Economic Prosperity to Recession: A Self-Inflicted Crisis.

On January 25th, President Donald Trump inherited a thriving U.S. economy. With soaring stock values, unemployment at record lows, it was clear that these economic wins signaled continued prosperity. Many Americans were optimistic that the economic boom would persist and even grow further under Trump. However, many remained skeptical. Their concerns were soon proven valid following Trump’s unpredictable and aggressive trade war against two of the United States closest allies, Canada and Mexico, which has sent the economy spiraling downwards. With rising costs of food, gas, electricity and housing, many Americans are struggling in a recessionary environment. But why did Trump wage a trade war, and what does this mean for the future of the US economy?

What Economy did Trump Inherit?

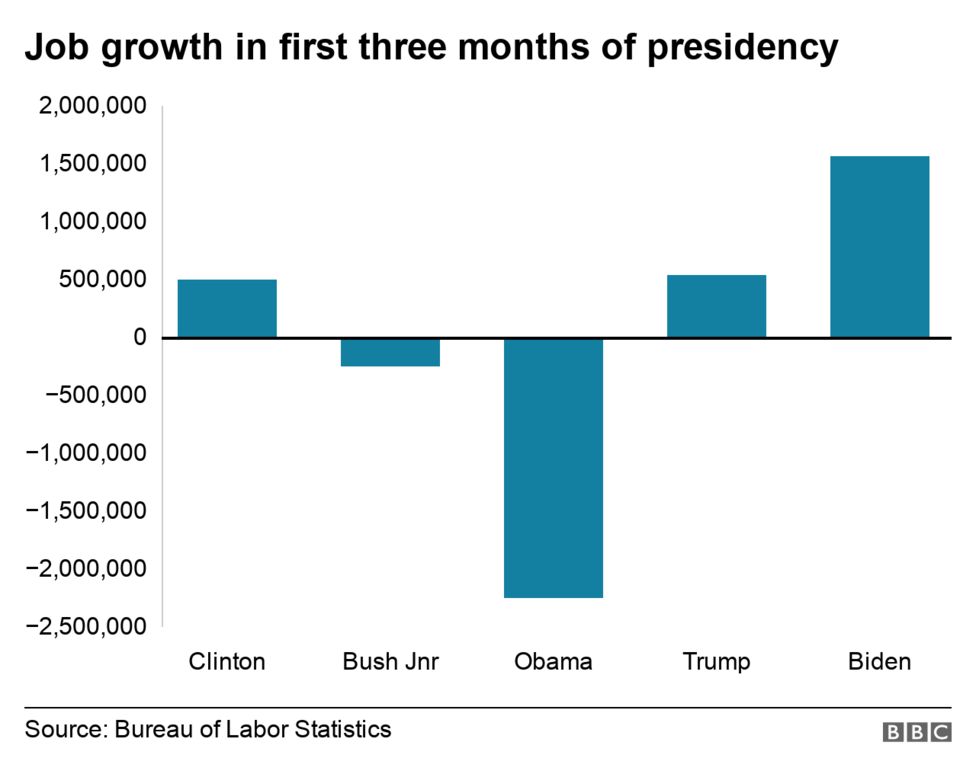

Trump took office amid economic strength, largely credited to the Biden administration, which successfully navigated post-pandemic challenges and curbed record-high inflation without triggering a recession. The Biden Administration had achieved historic gains in the job market, with the US economy adding jobs for 48 consecutive months, tying the second-longest period of employment expansion on record, according to Bureau of Labor Statistics data that goes back to 1939. This makes Biden the first US president to oversee monthly job gains for the entirety of his presidency. [1] Just 20 days ago, the US stock market and economy was thriving, with manufacturing set for long-term growth. Yet within weeks of taking office, Trump’s policies reversed these gains and sowed economic stability. What specific actions did the Trump administration undertake to cause the economy to slowly recess?

[2]

An Unprecedented Trade War Which Ignited Global Instability

Despite being in office for less than 100 days, Trump’s policies have already caused economic volatility and shattered many investors' confidence. Shortly following his inauguration, Trump announced plans to impose 25% tariffs on imports from Canada and Mexico. Additionally, he directed the U.S Commerce Department to study trade deficits and tariff impacts while initiating consultations on the Canada-United States-Mexico Agreement (CUSMA), the successor to NAFTA, which he renegotiated during his first term. Many believed that such impositions of tariffs would significantly harm the economy, leading to Foreign Affairs Minister Melanie Joly and other Canadian ministers to travel to Washington, D.C., to meet with U.S. lawmakers and Trump administration officials, including U.S. Secretary of State Marco Rubio, in an attempt to diplomatically avoid the tariffs and negotiate a solution.

On February 1st, Trump signed an executive order to impose 25% tariffs on Canadian and Mexican goods, set to take effect on February 4th. However, he failed to anticipate the swift retaliatory measures from U.S trading partners. Just one day later, Canada struck back with $30billion in retaliatory tariffs on U.S goods, set to take effect alongside Trump’s tariffs. Furthermore, Canadian provinces and businesses vowed to remove U.S alcohol from store shelves and cancel American business contracts. A social media-driven consumer boycott against U.S products also quickly gained traction in Canada, with many supermarkets prominently labeling ‘Made in Canada’ goods so consumers can identify what products to purchase and which ones to boycott.

Facing immediate economic fallout and diplomatic pressure, Trump abruptly delayed his tariffs on Canada and Mexico by 30 days after securing commitments on border security from Canadian Prime minister Justin Trudeau and Mexican President Caludia Sheinbaum. However, Trump simultaneously reinstated an additional 25% tariff on all foreign steel and aluminum imports, leading to a total 50% tariff on those goods. The move was seen as an aggressive attempt to push domestic production but was quickly met with further retaliation. By February 21st, Canada’s retaliatory tariffs had taken effect. On March 10th, Ontario Premier Doug Ford escalated tensions by imposing a 25% export tax on electricity sold to U.S. states like Michigan, Minnesota, and New York. This came as a shock and worry to many working Americans whom rely on Canadian electricity. The following day, Trump retaliated by increasing tariffs on Canadian steel and aluminum exports to 50%, prompting the White House to denounce Ford’s actions as "egregious and insulting."[3] As tensions worsened, businesses in both countries faced uncertainty, and American consumers began to feel the ripple effects of rising costs in multiple industries.

Wall Street in Freefall

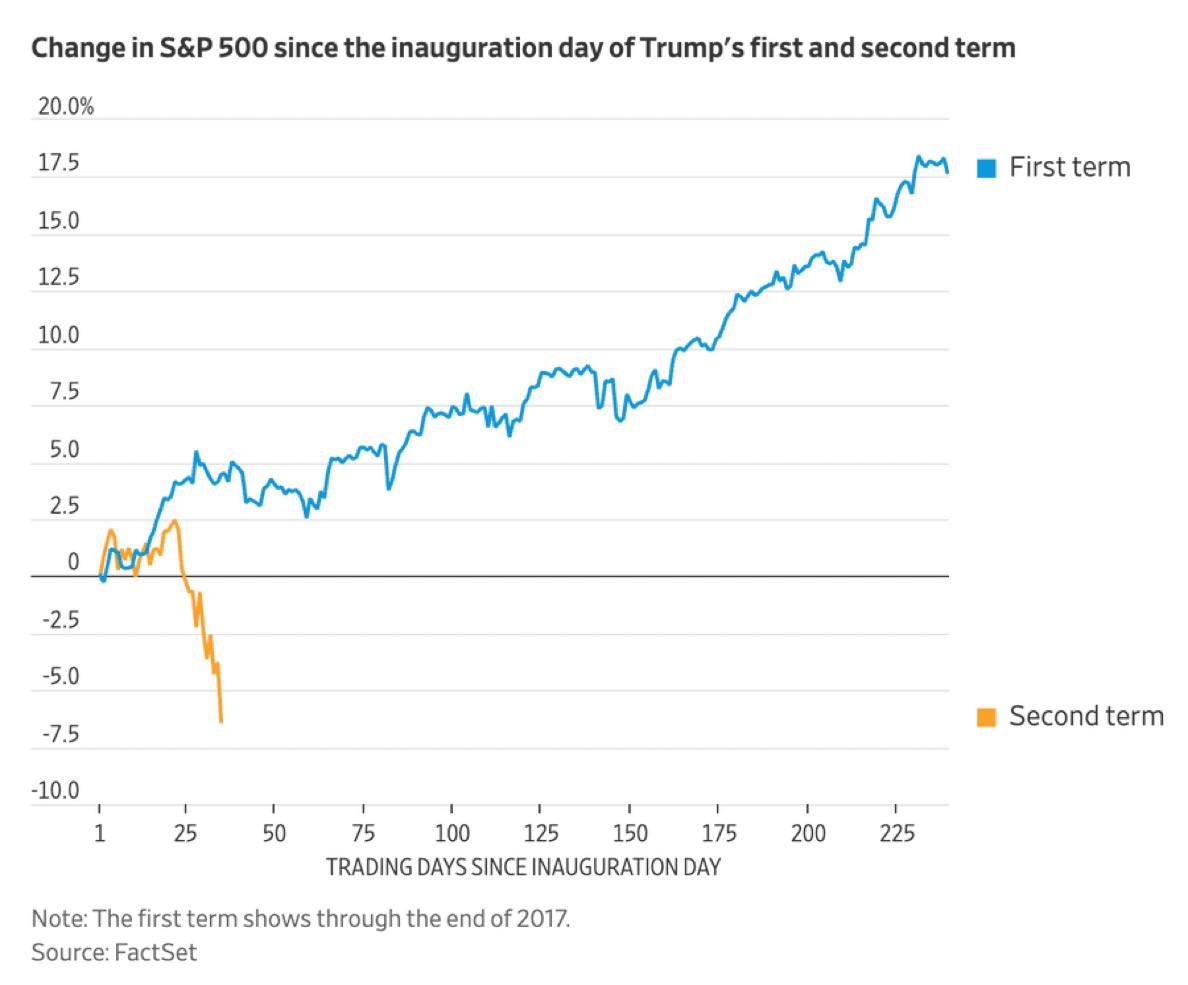

Trump's unpredictable trade policies sent shockwaves through financial markets. On Tuesday, the U.S. stock market suffered its worst downturn in months, failing to recover from Monday's steep losses. The Dow Jones Industrial Average fell by 400 points (1%), while the Nasdaq continued its decline after experiencing its worst trading day in over two years. Furthermore, The S&P 500, which had already endured its worst week in six months, lost another 3% on Monday, plunging nearly 9% from its February 19th high.

The tech sector was hit particularly hard, as investors fled high-risk stocks in favor of defensive assets like utilities and consumer staples. Tesla saw a staggering 13% drop, while major firms like Nvidia, Apple, and Alphabet all lost over 5%. The economic turbulence was further exacerbated by growing concerns over how deeply the tariffs would affect international trade relations.

Economic analysts warned of deepening market uncertainty. "The stock market is losing confidence in the Trump 2.0 policies," Ed Yardeni, president of Yardeni Research, told CNN. "Everything is at risk now, mostly because of the administration’s rush to establish so many objectives in a very short period of time—with unintended consequences."[4]

Goldman Sachs also raised its recession forecast from 15% to 20%, citing the increasing risk of trade instability. Meanwhile, CNN’s Fear & Greed Index tumbled into "extreme fear" territory, a stark shift from "neutral" just weeks earlier.

An International Trade War at Bay?

The economic damage wasn’t limited to North America, however. China has also swiftly retaliated against Trump’s tariffs, imposing an additional 15% tax on key U.S. agricultural products, including chicken, pork, soybeans, and beef. This response followed Trump’s March 4th decision to double levies on Chinese imports to 20%. China's Commerce Ministry announced that goods already in transit would be exempt from the retaliatory tariffs until April 12.[5] This move signaled that China was willing to escalate the trade conflict, potentially worsening global market conditions. Meanwhile, the European Union introduced countermeasures targeting U.S. industrial and agricultural goods worth $28 billion. The EU reimposed duties on American textiles, home appliances, and agricultural exports, as well as symbolic products like motorcycles, bourbon, peanut butter, and jeans, echoing retaliatory measures from Trump’s first term in office. [5] With trade tensions escalating across multiple regions, American industries found themselves under mounting pressure, forcing companies to pass costs onto consumers.

The Cost of Trump’s Trade War: Who Pays the Price?

In conclusion, Trump has proven that his reliance on tariffs as a foreign policy tool does more harm than good. His erratic trade war has shattered investor confidence, led to market downturns, and raised costs for American consumers. Diplomacy has not been effective in negotiating tariffs, leaving the U.S. economy vulnerable to further economic shocks. As more countries retaliate, the economic burden continues to fall on American workers, businesses, and consumers, who now face the stark reality of increasing inflation and job market uncertainty. Furthermore, with trade tensions extending beyond North America to China and the European Union, American workers and businesses are left footing the bill for Trump's unpredictable and short-sighted policies. As economists warn of a looming recession, the question remains: how much more economic damage will Trump’s trade wars inflict before he changes course?

Sources:

[1]https://edition.cnn.com/2025/01/19/economy/us-biden-economic-legacy/index.html

[2]https://www.bbc.co.uk/news/57070054

[3]donald-trump-tariffs-canada-timeline

[4]https://edition.cnn.com/2025/03/11/business/recession-economy-trump-dow-stocks/index.html

[5]trump-tariffs-mexico-china-canada-trade-cfe1fa82a47f1bca21a82f4b504486c8